Avensia

6,94 SEK

-0,86 %

Mindre end 1K følgere

AVEN

First North Stockholm

IT Services

Technology

Oversigt

Finansielt overblik og estimater

Ejerskab

Dividend

Investorkonsensus

-0,86 %

-11,93 %

-17,97 %

-22,72 %

-30,46 %

-30,46 %

-30,95 %

-52,79 %

-74,49 %

Avensia is a technology company that implements and delivers e-commerce solutions and digital infrastructure through platforms, strategy and consulting. Avensia offers digital solutions and products that connect physical and digital commerce to what is called omnichannel, seamless and unified shopping experiences across all channels. Avensia is headquartered in Lund and also operates in markets across Europe and North America.

Læs mereMarkedsværdi

257,64 mio. SEK

Aktieomsætning

1,86 t SEK

Omsætning

423,25 mio.

EBIT %

7,5 %

P/E

11,97

Udbytteafkast, %

8,65 %

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

6.5

2026

Delårsrapport Q1'26

6.5

2026

Generalforsamling '26

7.5

2026

Årligt udbytte

Alle

Analyse

Selskabsmeddelelser

Eksterne analyser

ViserAlle indholdstyper

Redeye: Avensia (Q3 Review) - Commerce Strong, IM Drags Sales and Profitability

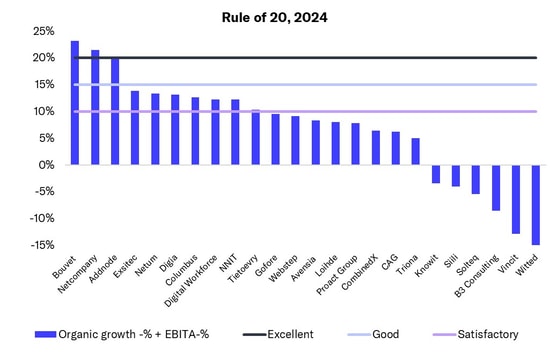

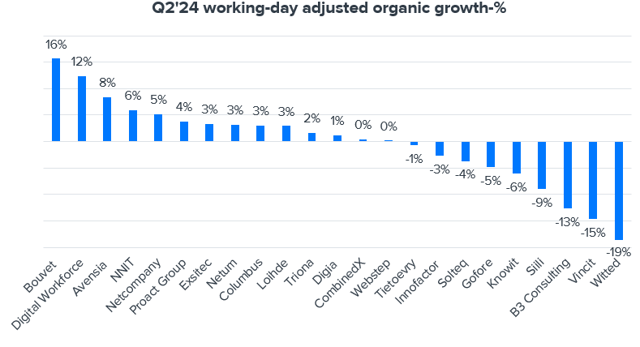

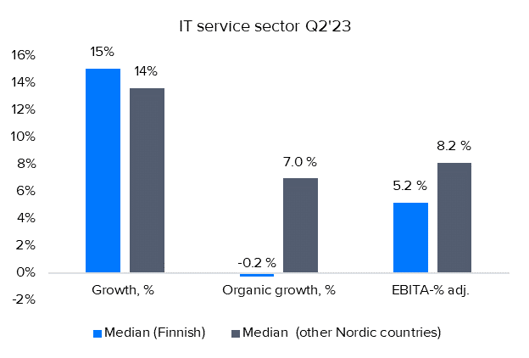

Nordic IT service sector Q2’25: Difficulties across geographies

Bliv en del af Inderes community

Gå ikke glip af noget - opret en konto og få alle de mulige fordele

Inderes konto

Følgere og notifikationer om fulgte virksomheder

Analytikerkommentarer og anbefalinger

Værktøj til at sammenligne aktier og andre populære værktøjer