Titanium

6.54 EUR

+3.81 %

6,521 following

TITAN

First North Finland

Financial Services

Financials

Overview

Financials & Estimates

+3.81 %

+4.47 %

-3.54 %

-2.10 %

-33.67 %

-38.59 %

-56.11 %

-46.39 %

-6.17 %

Titanium operates in the financial services industry. The group offers a wide range of financial services, mainly in asset management, loan financing and pensions. The group also manages a number of investment funds and structured financial products. Titanium was originally founded in 2009 and is headquartered in Helsinki.

Read moreMarket cap

67.83M EUR

Turnover

127.13K EUR

P/E (adj.) (25e)

13.53

EV/EBIT (adj.) (25e)

8.87

P/B (25e)

4.28

EV/S (25e)

2.81

Dividend yield-% (25e)

7.01 %

Latest research

Latest analysis report

Released: 03.10.2023

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Risk

Business risk

Valuation risk

Low

High

All

Research

Webcasts

ShowingAll content types

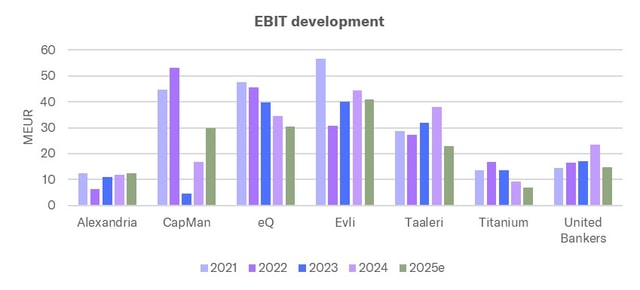

Significant differences in the quality of asset managers' earnings

Asset managers' early-year results do not tell the whole story about market developments shown below

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools