Gubra

375,00 DKK

-5,26 %

Mindre end 1K følgere

GUBRA

NASDAQ Copenhagen

Biotechnology & Pharmaceuticals

Health Care

Oversigt

Finansielt overblik og estimater

Ejerskab

Dividend

Investorkonsensus

-5,26 %

-8,94 %

-27,54 %

-22,20 %

-5,02 %

-30,30 %

-

-

+240,91 %

Gubra er en medicinalvirksomhed. Virksomhedens aktiviteter er fokuseret på de tidlige stadier af lægemiddeludvikling. De udfører hovedsageligt forskning og udvikling inden for stofskifte- og fibrotiske sygdomme.Virksomhedens produktportefølje omfatter flere brands og lægemidler, og aktiviteterne foregår på globalt plan med den største tilstedeværelse i Nordamerika og Norden. Hovedkontoret ligger i Hørsholm, Danmark.

Læs mereMarkedsværdi

6,13 mia. DKK

Aktieomsætning

23,42 mio. DKK

Omsætning

2,64 mia.

EBIT %

81,54 %

P/E

3,61

Udbytteafkast, %

-

Seneste analyse

Seneste analyse

Udgivelse: 01.12.2025

Omsætning og EBIT-margin

Omsætning mia.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

NOTICE TO CONVENE ANNUAL GENERAL MEETING 2026 GUBRA A/S

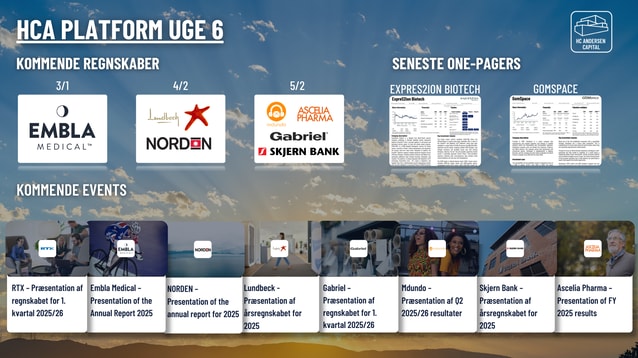

Gubra - Præsentation af årsregnskabet for 2025

Bliv en del af Inderes community

Gå ikke glip af noget - opret en konto og få alle de mulige fordele

Inderes konto

Følgere og notifikationer om fulgte virksomheder

Analytikerkommentarer og anbefalinger

Værktøj til at sammenligne aktier og andre populære værktøjer