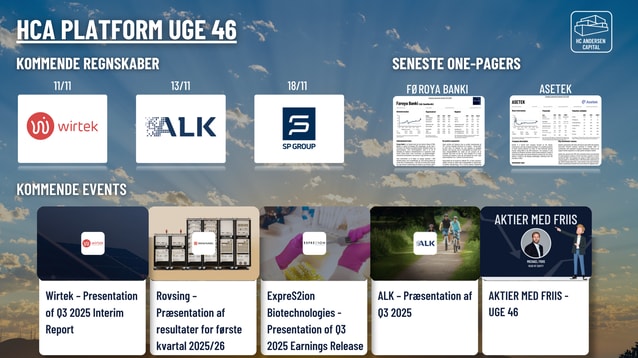

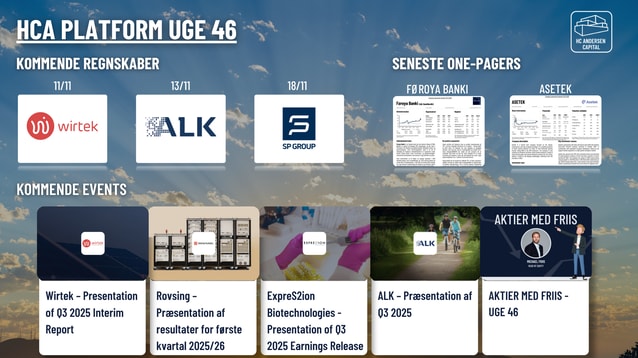

Wirtek

5.40 DKK

0.00 %

Less than 1K followers

WIRTEK

First North Denmark

Telecommunications

Technology

Overview

Financials & Estimates

Ownership

Dividend

Investor consensus

0.00 %

-0.92 %

+12.03 %

+25.58 %

-2.70 %

-24.48 %

-62.63 %

-78.05 %

-88.75 %

WirTek is an IT company. The company is focused on developing software and hardware solutions that affect web, mobile and integrated complete systems. Operations are held on a global level, with the largest presence in the Nordic region and Europe, where customers mainly consist of small and medium-sized business customers. WirTek was founded in 2001 and is headquartered in Aalborg.

Read moreMarket cap

42.78M DKK

Turnover

14.2K DKK

Revenue

71.87M

EBIT %

4.26 %

P/E

20

Dividend yield-%

4.26 %

Coverage

Latest research

Latest analysis report

Released: 13.11.2025

Revenue and EBIT-%

Revenue M

EBIT-% (adj.)

EPS and dividend

EPS (adj.)

Dividend %

Financial calendar

18.3

2026

Annual report '25

15.4

2026

General meeting '26

13.5

2026

Interim report Q1'26

All

Research

Webcasts

Press releases

ShowingAll content types

Vækstaktier.dk: Wirtek vil finde tilbage på vækstsporet i 2026 og indleder med nyt partnerskab

Vækstaktier.dk: Wirtek aims to return to growth in 2026 and begins with new partnership

Join Inderes community

Don't miss out - create an account and get all the possible benefits

Inderes account

Followings and notifications on followed companies

Analyst comments and recommendations

Stock comparison tool & other popular tools