Penneo

Mindre end 1K følgere

Penneo er en dansk Software-as-a-Service (SaaS)-virksomhed, der leverer løsninger til digital signering, dokument-workflow og compliance såsom et Know Your Customer-produkt (KYC), der hjælper virksomheder med at overholde anti-hvidvask-lovgivningen (AML). Penneo blev etableret i Danmark i 2014, og virksomheden har nu mere end 3.000 kunder i Danmark, Sverige, Norge, Finland og Belgien. Penneos primære kunder er revisorer, og virksomheden har ambitionen om at blive markedsleder og den foretrukne partner for revisions- og regnskabsbranchen i Europa. Penneo er noteret på Nasdaq Copenhagen Main Market.

Læs mereSeneste analyse

Seneste analyse

Udgivelse: 30.08.2024

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

Eksterne analyser

ViserAlle indholdstyper

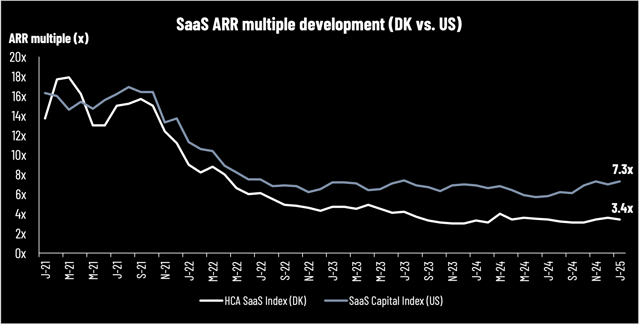

HCA SaaS update January 2025: DeepSeek – a Cisco moment for investors

Penneo: Major Shareholder Announcement

Bliv en del af Inderes community

Gå ikke glip af noget - opret en konto og få alle de mulige fordele

Inderes konto

Følgere og notifikationer om fulgte virksomheder

Analytikerkommentarer og anbefalinger

Værktøj til at sammenligne aktier og andre populære værktøjer