Hexicon

0,14 SEK

-0,74 %

Mindre end 1K følgere

HEXI

First North Stockholm

Renewable

Energy

Oversigt

Finansielt overblik og estimater

Ejerskab

Investorkonsensus

-0,74 %

+19,47 %

+8,00 %

-12,62 %

-38,07 %

-17,78 %

-88,75 %

-

-95,70 %

Hexicon is a project developer in offshore wind power, with the goal of opening up new markets in countries with deep water. The company is also a technology provider with TwinWind, a patented floating wind design. The technology enables increased use of global wind power and can thus contribute to increased access to renewable energy. Hexicon operates in several markets in Europe, Africa, Asia and North America.

Læs mereMarkedsværdi

49,11 mio. SEK

Aktieomsætning

49,87 t SEK

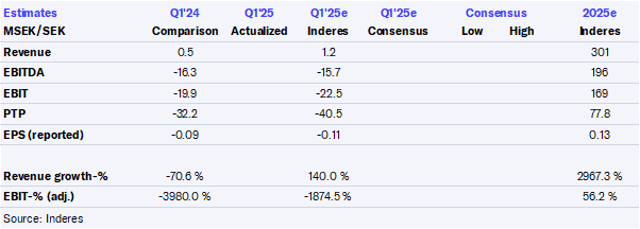

Omsætning

9,8 mio.

EBIT %

-932,65 %

P/E

-

Udbytteafkast, %

-

Omsætning og EBIT-margin

Omsætning mio.

EBIT-% (adj.)

EPS og udbytte

EPS (adj.)

Udbytte %

Finanskalender

26.2

2026

Årsrapport '25

28.5

2026

Delårsrapport Q1'26

27.8

2026

Delårsrapport Q2'26

Alle

Analyse

Selskabspræsentationer

Selskabsmeddelelser

ViserAlle indholdstyper

Notice to attend extraordinary general meeting in Hexicon AB (publ)

Hexicon announces impairment related to the UK-based TwinHub project of SEK 115 million

Bliv en del af Inderes community

Gå ikke glip af noget - opret en konto og få alle de mulige fordele

Inderes konto

Følgere og notifikationer om fulgte virksomheder

Analytikerkommentarer og anbefalinger

Værktøj til at sammenligne aktier og andre populære værktøjer